222 Registration Begins: New Car Registrations For June 2022 Released.

The Society of the Irish Motor Industry (SIMI), today (July 1st) released the official 221 new vehicle registration figures for June.

New car registrations for June were down 22% (2,154) when compared to June 2021 (2,762). Registrations year to date are up 2.1% (65,176) on the same period last year (63,853) and are 19.3% behind (80,758) that of pre-Covid levels.

Light Commercials vehicles (LCV) are down 36.0% (632) compared to June last year (988) and year to date are down 23.3% (13,062). HGV (Heavy Goods Vehicle) registrations are up 8.82% (111) in comparison to June 2021 (102). Year to date HGV’s are down 11.0% (1,359).

Used car imports for June (4,346) have seen a decrease of 22.8% on June 2021 (5,629). Year to date imports are down 32.6% (24,112) on 2021 (35,753).

For the month of June 187 new electric vehicles were registered compared to 390 in June 2021. So far this year 8,444 new electric cars have been registered in comparison to 4,330 on the same period 2021.

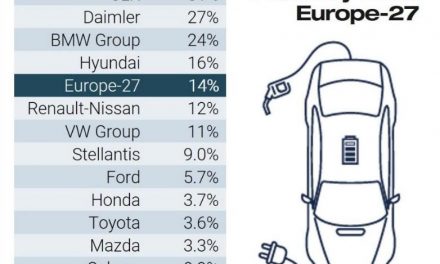

Electric Vehicle, Plug-in Hybrids and Hybrids continue to increase their market share, with a combined market share now of 42.49%. Petrol continues to remain dominant with 28.22%, Diesel accounts for 26.87%, Hybrid 22.50%, Electric 12.96% and Plug-in Electric Hybrid 7.03%.

Commenting on the new vehicle registrations Brian Cooke, Director General SIMI said: “New car registrations for the first half of the year are marginally ahead (2.1%) of last year but remain 19.3% behind that of 2019 (pre-covid levels). The continuing surge in Electric Vehicle sales, up 97% for the first half of the year, continues to be the one positive aspect of the new car market. While overall new car registrations for June are down 22% on the same month last year, the Industry is as ever optimistic that the new 222 registration period, which begins today, will help boost sales and attract vital trade-ins for the used car market. Feedback from retailers is that July will be very busy, and consumers are advised to shop around for the best deals on new and used cars.

Despite pent-up demand following two years of interrupted business, new car sales continue to drag due to supply constraints. While the supply issues will start to unwind in the short term, we now have the spectre of inflation and global political uncertainty. These have the potential to dampen new car demand at this critical juncture in reducing transport emissions. In this environment it is vital that Government continues to incentivise electric vehicles by extending current supports, and also refrain from any further taxation increases which will only suppress demand hampering our ability to decarbonise the national fleet.”

Visit https://stats.beepbeep.ie/ for full stats info

2022 Total New Vehicle Stats

• New Car sales total year to date (2022) 65,176 v (2021) 63,853 +2.1%

• New Car sales total year to date (2022) 65,176 v (2019) 80,758 -19.3%

• New Car sales total June (2022) 2,154 v (2021) 2,762 -22.0%

• New Car sales total June (2022) 2,154 v (2019) 1,408 +53.0%

• Light Commercial Vehicles sales year to date (2022) 13,062 v (2021) 17,023 -23.3%

• Light Commercial Vehicles sales year to date (2022) 13,062 v (2019) 15,317 -14.7%

• Light Commercial Vehicles sales total June (2022) 632 v (2021) 988 -36.0%

• Light Commercial Vehicles sales total June (2022) 632 v (2019) 747 -15.4%

• Heavy Goods Vehicle total sales year to date (2022) 1,359 v (2021) 1,527 -11.0%

• Heavy Goods Vehicle total sales year to date (2022) 1,359 v (2019) 1,803 -24.6%

• Heavy Goods Vehicle total sales June (2022) 111 v (2021) 102 +8.8%

• Heavy Goods Vehicle total sales June (2022) 111 v (2019) 316 -64.9%

• Used Car Imports total year to date (2022) 24,112 v (2021) 35,753 -32.6%

• Used Car Imports total year to date (2022) 24,112 v (2019) 53,126 -54.6%

• Used Car Imports total June (2022) 4,346 v (2021) 5,629 -22.8%

• Used Car Imports total June (2022) 4,346 v (2019) 8,060 -46.1%

• New Electric Vehicles sales total year to date (2022) 8,444 v (2021) 4,330 +95.01%

• New Electric Vehicles sales total year to date (2022) 8,444 v (2019) 1,954 +332.1%

• New Electric Vehicles sales June (2022) 187 v (2021) 390 -52.1%

• New Electric Vehicles sales June (2022) 187 v (2019) 53 -252.8%

• 5 Top selling car brands year to date are: 1. TOYOTA 2. HYUNDAI 3. VOLKSWAGEN 4. KIA, 5. SKODA

• 5 Top car model’s year to date are 1. HYUNDAI TUCSON, 2. TOYOTA COROLLA, 3. TOYOTA C-HR, 4. TOYOTA RAV 4, 5. TOYOTA YARIS

• Top Selling Car June 2022: HYUNDAI TUCSON

• 5 Top new Electric Vehicle car model’s year to date: 1. VOLKSWAGEN ID.4, 2. HYUNDAI IONIQ 5, 3. KIA EV6, 4. NISSAN LEAF, 5. TESLA MODEL 3

• Market share by engine type 2022: Petrol 28.22%, Diesel 26.87%, Hybrid 22.50%, Electric 12.96%, Plug-In Electric Hybrid 7.03%

|

New Car Registrations by County (January-June) 2022 |

|||||

|

County |

2022 Units |

2021 Units |

% Change |

2022 % Share |

2021 % Share |

|

Carlow |

740 |

720 |

2.78 |

1.14 |

1.13 |

|

Cavan |

681 |

715 |

-4.76 |

1.04 |

1.12 |

|

Clare |

1322 |

1358 |

-2.65 |

2.03 |

2.13 |

|

Cork |

8381 |

7792 |

7.56 |

12.86 |

12.2 |

|

Donegal |

1542 |

1501 |

2.73 |

2.37 |

2.35 |

|

Dublin |

24911 |

25726 |

-3.17 |

38.22 |

40.29 |

|

Galway |

2828 |

2511 |

12.62 |

4.34 |

3.93 |

|

Kerry |

1460 |

1365 |

6.96 |

2.24 |

2.14 |

|

Kildare |

2901 |

2698 |

7.52 |

4.45 |

4.23 |

|

Kilkenny |

1243 |

1208 |

2.9 |

1.91 |

1.89 |

|

Laois |

795 |

805 |

-1.24 |

1.22 |

1.26 |

|

Leitrim |

266 |

248 |

7.26 |

0.41 |

0.39 |

|

Limerick |

2196 |

2258 |

-2.75 |

3.37 |

3.54 |

|

Longford |

341 |

335 |

1.79 |

0.52 |

0.52 |

|

Louth |

1550 |

1463 |

5.95 |

2.38 |

2.29 |

|

Mayo |

1186 |

1105 |

7.33 |

1.82 |

1.73 |

|

Meath |

2315 |

2073 |

11.67 |

3.55 |

3.25 |

|

Monaghan |

530 |

579 |

-8.46 |

0.81 |

0.91 |

|

Offaly |

772 |

732 |

5.46 |

1.18 |

1.15 |

|

Roscommon |

621 |

629 |

-1.27 |

0.95 |

0.99 |

|

Sligo |

679 |

664 |

2.26 |

1.04 |

1.04 |

|

Tipperary |

1801 |

1739 |

3.57 |

2.76 |

2.72 |

|

Waterford |

1687 |

1679 |

0.48 |

2.59 |

2.63 |

|

Westmeath |

951 |

955 |

-0.42 |

1.46 |

1.5 |

|

Wexford |

1900 |

1602 |

18.6 |

2.92 |

2.51 |

|

Wicklow |

1577 |

1393 |

13.21 |

2.42 |

2.18 |